Why Brokers Don’t Quote More Self-Insured Groups and What MGUs and Carriers Can Do About It

Self-insured health plans offer employers flexibility, cost control, and the ability to design benefits that address the specific health needs of their workforce. For employer groups, particularly those with stable risk profiles, self-insurance can reduce costs, improve employee wellness, and foster long-term savings. However, despite these advantages, brokers often hesitate to introduce self-insurance to their clients, particularly small to mid-sized businesses. As MGUs (Managing General Underwriters) and carriers, understanding the reasons behind this hesitation and providing the necessary tools to ease the process is key to overcoming these barriers.

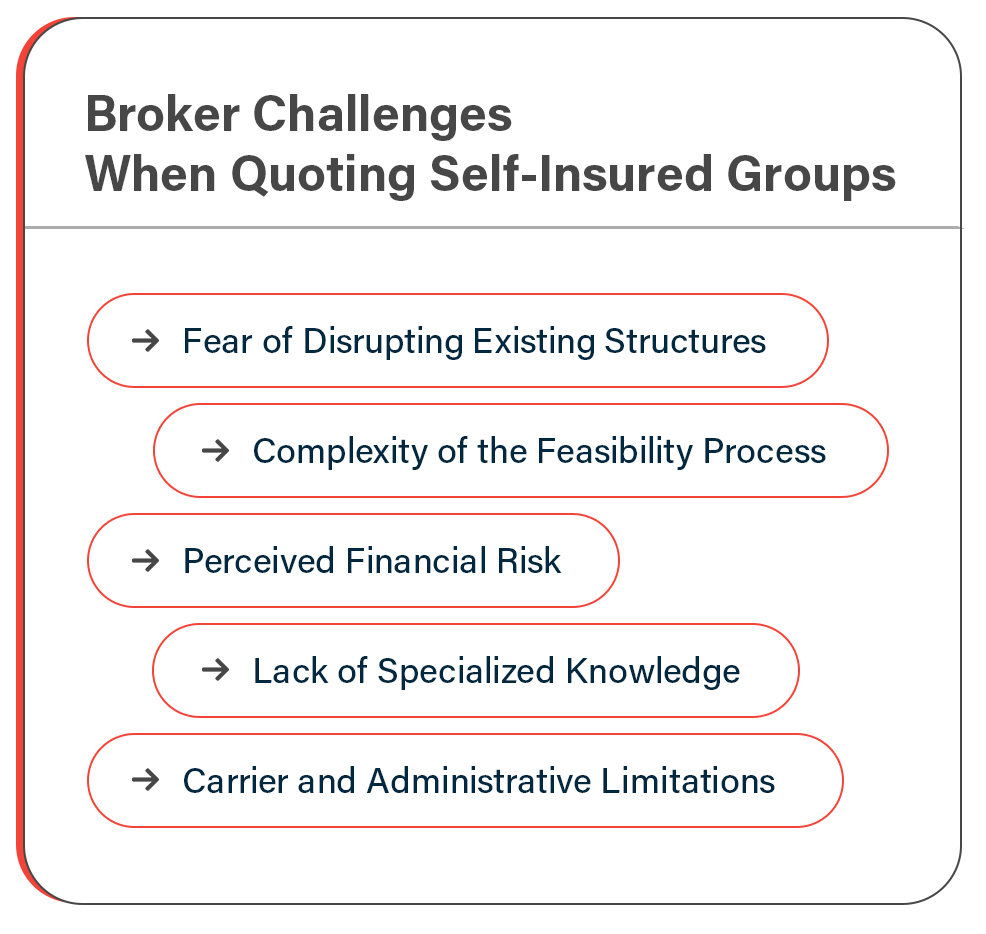

Key Challenges Brokers Face When Quoting Self-Insured Groups

Even for brokers familiar with the benefits of self-insurance, there are significant challenges when introducing self-insured options to clients. MGUs and carriers need to understand these hurdles and equip brokers with tools that make self-insurance a more viable and attractive option.

Fear of Disrupting Existing Structures

One of the most common reasons brokers hesitate to propose self-insured plans is the fear of disrupting the status quo. For many employers, especially those accustomed to fully insured plans, the perceived complexity of transitioning to a self-insured model can feel overwhelming. For example, a 400-lives group might see an opportunity to manage chronic conditions such as diabetes through custom health campaigns targeting A1C levels. However, the shift from a fully insured plan to self-insurance requires changes to administrative processes, claims handling, and stop-loss coverage, all of which can be seen as disruptive to the existing structure.

Complexity of the Feasibility Process

Assessing whether a group is a viable candidate for self-insurance is not a simple process, and brokers often find this complexity to be a major deterrent. The steps involved include:

-

- Data Collection: Gathering comprehensive data, including claims history, health risk assessments, and demographic information, is essential to assess the group’s risk profile.

- Risk Assessment: The carrier must conduct a thorough analysis of claims data and population health metrics. This is where brokers, who may lack in-depth underwriting expertise, might feel out of their depth. The analysis needs to estimate future claims costs while evaluating stop-loss insurance needs.

- Stop-Loss Evaluation: Determining appropriate stop-loss attachment points and understanding how specific and aggregate coverage will protect against catastrophic claims is another layer of complexity. Even though the group may benefit from managing risks like diabetes or heart disease through wellness programs, understanding the financial implications of claims variability is critical.

- Cost Modeling: The feasibility process also requires running financial projections to compare the cost of self-insurance with fully-insured options. Brokers must work with carriers to create models that take into account both short-term costs and long-term savings potential.

- Compliance and Regulatory Filings: Navigating ERISA compliance and preparing necessary filings like Form 5500 adds another layer of difficulty, particularly for smaller employers who may not be familiar with these requirements.

Perceived Financial Risk

A major reason brokers shy away from quoting self-insured plans is the inherent financial risk that comes with self-insurance. Unlike fully-insured plans, where the carrier assumes the risk, self-insured employers take on the responsibility of paying employee health claims directly. For smaller groups like the 400-lives employer, brokers may fear that the employer doesn’t have the financial stability to handle claims volatility, particularly in years with unexpectedly high claims.

For MGUs and carriers, offering flexible stop-loss solutions and clear cost projections can alleviate these concerns. By demonstrating how specific and aggregate stop-loss coverage can protect against high claims, MGUs can make the financial risk more manageable for brokers and their clients.

Lack of Specialized Knowledge

Many brokers who focus primarily on fully-insured plans do not have the specialized knowledge needed to confidently explain the benefits of self-insurance to their clients. Self-insurance requires an understanding of claims variability, stop-loss coverage, and the potential for long-term savings, which can make it harder for brokers to present this option.

MGUs and carriers can bridge this gap by providing brokers with educational resources and tools that allow them to become more proficient in self-insurance. By offering underwriting support and simplified tools for data collection and analysis, we can make it easier for brokers to navigate the complexity of self-insured plans.

Carrier and Administrative Limitations

Brokers may hesitate to recommend self-insurance if they believe that the administrative support from carriers and TPAs is insufficient. The additional complexity of handling claims, implementing wellness programs, and managing stop-loss coverage requires strong carrier partnerships and administrative capabilities. Without reliable systems and processes in place, brokers may be reluctant to take the leap into self-insurance.

In summary, I think you see the picture, a broker sees the same compensation structure but the effort involved is significantly more. For MGUs and carriers, offering streamlined processes and support for brokers during this feasibility assessment all the way to administrative support is critical to reducing the burden and encouraging more self-insured quotes.

Leveraging Assessment Tools to Simplify the Process

MGUs and carriers play a pivotal role in making self-insurance more accessible by providing brokers with tools that simplify the feasibility assessment. One such tool is UWDataHub, an AI-powered underwriting platform that integrates with leading models like Gradient AI and Milliman.

How UWDataHub Streamlines Self-Insurance Feasibility

UWDataHub automates many of the manual processes that make self-insurance feasibility so daunting for brokers. It integrates with underwriting guidelines and provides pre-assessment outputs that can jump start the assessment process and help a broker make the case for doing indepth analysis.:

Data Collection: UWDataHub has AI driven tools that allow easy extraction of data whether it is current census in different formats or plan design information. This allows brokers to overcome the initial challenge of gathering basis data.

AI-Driven Risk Assessment: By integrating with underwriting models whether 3rd party or internal, UWDataHub performs advanced risk assessments, allowing MGUs and carriers to quickly determine a group’s self-insurance viability. This reduces the time brokers spend manually assessing claims variability and potential risk exposure.

Streamlined Feasibility Process: The tool enables brokers to easily initiate the self-insurance feasibility process, from gathering quotes with stop-loss evaluations to building out demo proposals, with minimal friction for employers.

The key is to not only examine the current book of business but allow your broker partner to get to opportunities that are being under-served right now. A right tool like UWDataHub – can become your Elder Wand in the hands of your underwriting team, allowing you to tackle many problems not only at the beginning of the process but all the way through filtering, quoting and boosting your business.

Conclusion

While brokers often hesitate to quote self-insured plans due to the complexity of the feasibility process, the perceived financial risk, and the potential disruption to existing client setups, MGUs and carriers have the opportunity to change this dynamic. By implementing advanced tools like UWDataHub, you can reduce the burden of self-insurance assessments, making it easier for brokers to explore self-insurance as a viable option.

By simplifying the process, reducing administrative complexity, and offering strong support for brokers, MGUs and carriers can empower more employers to take advantage of the flexibility and cost savings that self-insurance offers. This not only benefits brokers and employers but also leads to healthier, more sustainable benefits programs for employees.