Streamlining Data Collection and Verification with DataHub.Insure Underwriting Workbench

Welcome to

“The Underwriter’s Guide to Efficiency: Everyday Wins with DataHub.Insure”

This blog series is designed to help underwriters like you work smarter, not harder. We’ll explore how DataHub.Insure simplifies your daily tasks and enhances your work experience. As your everyday partner, DataHub.Insure is here to streamline your underwriting processes, enabling you to focus on what you do best—assessing risk and making informed decisions.

The Challenge

Manual Data Collection and Verification

As an underwriter, you spend a significant portion of your time on manual data entry, verification, and analysis. This tedious process can lead to burnout and prevent you from concentrating on core underwriting activities. Additionally, limited access to data and outdated tools can hinder accurate risk assessments and slow down the application process. The constant need to gather and verify data from various sources adds unnecessary stress and inefficiency to your workflow.

![8396 [Converted]-01](https://www.empoweredmargins.com/wp-content/uploads/2024/06/8396-Converted-01.png)

The Solution

DataHub.Insure Automation

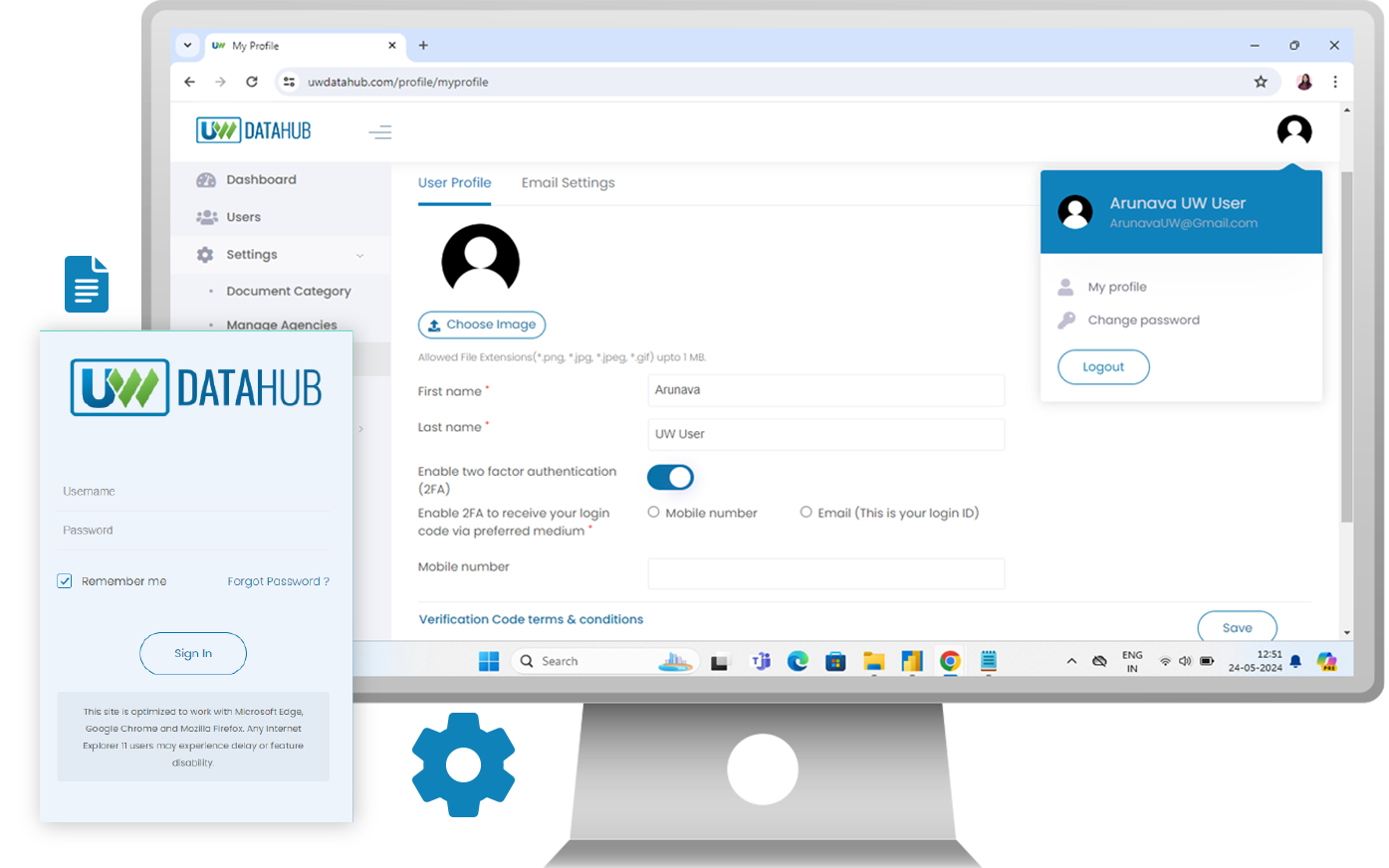

DataHub.Insure is specifically designed to address these challenges by automating the data collection process. Here’s how it works:

SmartExtractor™ for Automated Data Collection of Employer and Census Data:

-

- Automated Collection: The SmartExtractor™ functionality is a user-friendly interface designed to streamline the process of extracting group information and census data from uploaded files. This feature simplifies data management for brokers and underwriters, enabling efficient processing of employer and census data to generate risk scores and premiums for group health insurance.

- Ensuring Standardization: SmartExtractor™ standardizes data formats, ensuring all information is compatible and easily analyzable.

SmartRules™ Engine for Reducing Workload

-

- Highlight Parameters: SmartRules™ expands the opportunity for an underwriter to not only filter the risks but also highlights the essential parameters that influence a risk such as Industry, Area, Contribution strategy etc.

- Reducing Workload: By filtering incoming requests against predefined business rules and guidelines, the SmartRules™ Engine reduces the workload on underwriters, allowing them to focus on complex cases.

- Highlight Parameters: SmartRules™ expands the opportunity for an underwriter to not only filter the risks but also highlights the essential parameters that influence a risk such as Industry, Area, Contribution strategy etc.

SmartMatch™ for Plan Recommendations

-

- Customized Recommendations: SmartMatch™ empowers underwriters, brokers, and agents to compare various health plans based on multiple criteria, aiding them in selecting the best options for their clients.

- Data Consistency: This feature offers a structured method for adding, analyzing, and comparing health plans, ensuring that clients receive well-evaluated and tailored plan recommendations to meet their specific needs.

Saving Time and Increasing Efficiency

-

- Real-Time Dashboard: The dashboard provides instant access to all relevant data, allowing you to quickly analyze information and make decisions. Key performance indicators and risk metrics are updated continuously, giving you the most current view of your underwriting portfolio.

- Reporting: DataHub.Insure reporting tools enable you to generate detailed reports instantly. Whether you need a summary of recent quotes or an in-depth analysis of risk factors, the system provides the information you need without delay.

How It Works

How It Works

Conclusion

By automating the data collection and verification process with SmartExtractor™, validating data with SmartRules™, and providing tailored recommendations with SmartMatch™, DataHub.Insure Underwriting Workbench empowers you to work more efficiently, reduce errors, and focus on the critical aspects of underwriting. Stay tuned for our next blog post, where we’ll explore another feature of DataHub.Insure that simplifies your daily tasks and enhances your work experience.

Download The Guide

For a more comprehensive look at how DataHub.Insure can transform your underwriting processes, download our free guide, “Digital-First Underwriting using DataHub.Insure Underwriting Workbench.”

Stay tuned for the next post in our series, where we will dive deeper into how DataHub.Insure helps underwriters streamline other key tasks and workflows.

Empowered Margins – Empowering Underwriting Excellence