Navigating the complexities of health insurance is challenging

In States with multiple ACA players and a growing market of Association Health Plan options, Chamber plans and the like, choices are multiplying and price isn’t the only factor in determining ‘Product Fit’.

These same markets create a challenge for those at the Carrier tasked with managing ACA and Association based product portfolios, their respective risk pools and how, in front of the Group/Broker and Association, those product/network and pricing differences impact a group’s buying decision.

Carrier teams, and Brokers, ask these questions during the initial proposal, at renewal and even during the year reviewing risk pool health:

-

- Does a group’s experience, morbidity, demographics (initially or at renewal) make them a better fit for one pool or funding strategy over the other?

- Internally, what are the differences between the plan options/designs and pricing for our product portfolios?

- Competitively, how do our plans compare (pricing, options, design) to those of our competitors?

Compounding these questions is volume, both in the number of groups going to market and the 5-10 (if not more) plan options (per portfolio, per carrier, per association). Additionally, where and how does a team connect all these varied data systems in one place or one view? Ultimately, how you synthesize the answers and the output is where the value meets the road.

The answer to these questions is time consuming but with the right process and technology a scenario ripe for automation and scale.

Typically, Carriers and Brokers determine fit, by looking at morbidity scores, demographics, experience and, to a degree, the overall price sensitivity of the group. These factors help the Carrier and Broker determine what funding style or risk pool the group is better suited – in this case ACA or Association.

In the simplest view, healthy groups (low morbidity scores, young demographics, low claims) are a best fit for smaller pools. Groups with higher morbidity, older demographics and higher claims benefit from larger risk pools and the ability to spread the risk.

The Advantages of

Being in an ACA Pool

The Affordable Care Act (ACA) introduced several measures to stabilize health insurance markets and spread risk. One of the key components was the creation and enhancement of risk pools. Here are the main advantages of ACA risk pools:

Risk Mitigation

In a larger pool, the health risks are spread across a broader population. This means that individual health issues have less impact on the overall insurance rates.

Stable Rates

Larger pools often provide more stable and predictable insurance rates, as they are less affected by the health fluctuations of individuals.

Regulatory Protection

The ACA provides certain protections and standardized rates, which can be beneficial for groups with varying health demographics.

The Advantages of

Being in an Association Pool

Association health plans (AHPs) are group health insurance plans that allow small businesses and self-employed individuals to band together to purchase health insurance as a larger group. By pooling their resources, members of an AHP can often obtain coverage at lower costs and with more favorable terms than they might be able to achieve on their own. Here’s a breakdown of key aspects of AHPs:

Extended Coverage

Broader plan options compared to individual or small group markets.

Customizable Plans

Tailored benefits to meet the needs of specific industries or professions.

Lower Costs

Potentially lower premiums due to group purchasing power.

How AI Can Enhance Product Fit

Artificial intelligence (AI) is significantly enhancing the processes of determining product fit for groups. By connecting disparate data sets, workflows and technologies AI tools including UWDataHub provide connections and insight including:

Enhance Data Integration

Risk Score Integration

AI enabled tools like UWDataHub can integrate data from various sources such as third party risk models and a carrier’s internal (Excel Based) pricing models. This integrated approach increases the speed to quote.

Data Ingesting

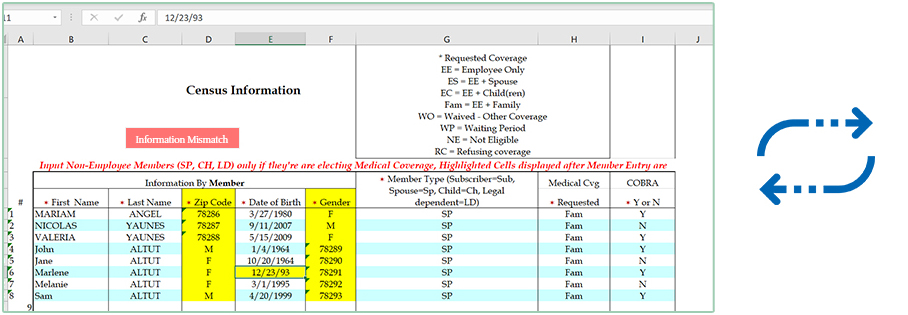

Powered by AI, data extraction tools (SmartExtractor™) automate data capture, standardize, and filter requests with predefined business rules. Desperate formats (CSV, XML, API), and Optical Character Recognition (OCR), eliminate manual intervention in data processing.

Product Comparisons

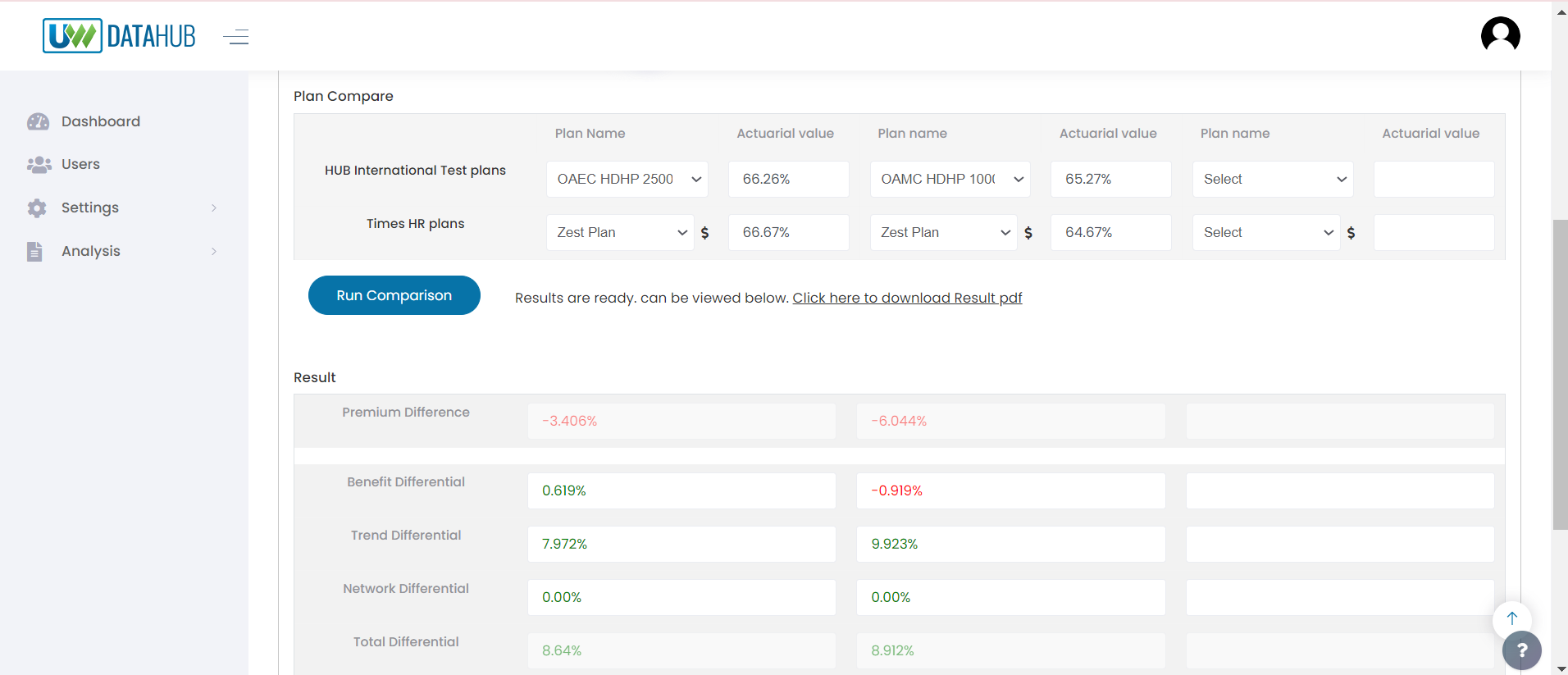

Internal Product Comparisons

Carriers with SmartMatch™ provide internal teams instant access to plan comparisons, specific to the group – pricing, plan and network designs, allowing Carriers with deep product portfolios to instantly identify, review and present to the Group “Data Driven” recommendations.

Competitor Analysis

Continuously monitor and analyze competitors’ offerings, helping carriers stay competitive by analyzing multiple product offerings.

Considering the multitude of data sources needed to adequately review and propose products, AI, and the tools incorporating it, can help carriers quickly and efficiently determine the right product/risk pool while providing the group valuable insights into why and how certain products/risk pools can be to their advantage.

The decision to join ACA or Association risk pool is multifaceted, involving morbidity scores, demographic factors, claims experience, competitive options and price. Small groups and Associations need to carefully evaluate their specific circumstances and health profiles. Consulting with experts and leveraging AI integrated tools, like UWDataHub, can provide the necessary insights to make the best choice for their health insurance needs.